Find the perfect funding options for your commercial property or business. We specialize in arranging commercial loans through our network of banks and credit unions. We arrange both conventional and SBA financing and make it easy.

Watch as we explain our process and why choosing Monarch Commercial Capital is your best option for financing commercial real estate, business acquisition and partner buy-outs, franchise start-ups and debt refinance and working capital loans.

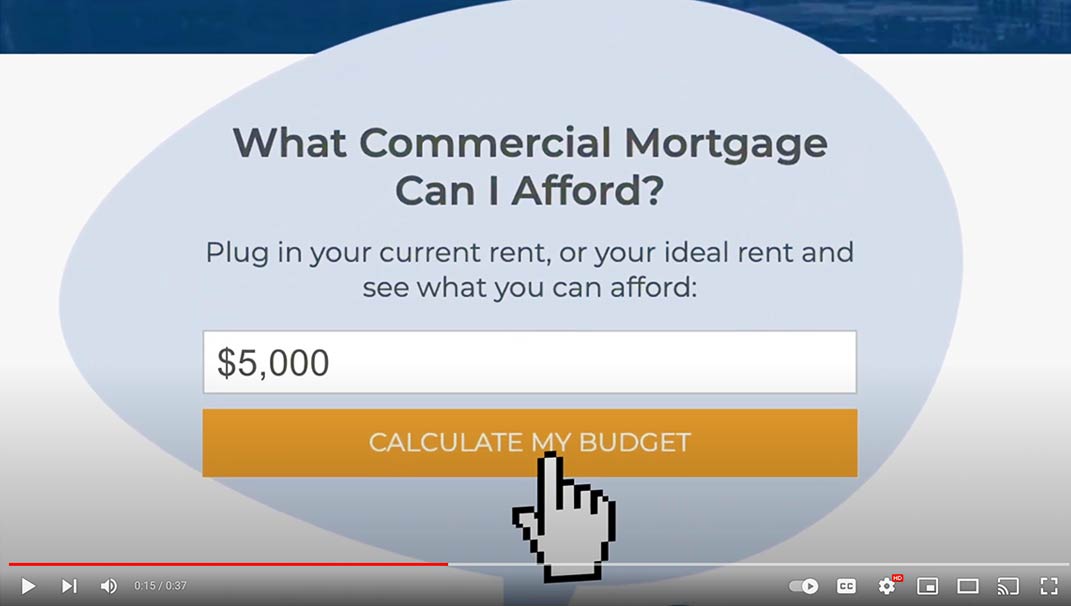

Plug in your current rent, or your ideal rent and see what you can afford:

We have developed software that allows you to create your own financing scenarios for your current listings. It’s a great tool to show to prospective buyers. All you have to do is enter a few specifics and it will create a financing scenario with side-by-side loan comparisons and payments for conventional, SBA 504, and SBA 7(a) loan options. Give it a try.

Commercial Real Estate Financing

Business Acquisition & Partner Buy-out

Franchise Start-Ups

Debt Refinance and Working Capital

Listen to former Monarch Commercial Capital clients as they describe their experience with Jon Kleven. They praise him for for his expertise and professionalism in helping them secure the commercial loan they needed to start and grow their business in Utah.

Choosing the best loan for your particular situation can be overwhelming and difficult. With so many options on the market, it can seem impossible to sort through everything available. This is where Monarch shines with options and education to allow you to feel comfortable that you selected the right loan. We help you sort through your options and help you find the right choice for your needs. Even if you choose to find financing elsewhere, let us give you our input and expertise on what kind of product would be the best fit for you; free of charge.

We work primarily with banks, credit unions and other financial institutions to provide conventional and SBA financing on all commercial properties. They must be zoned for commercial use. Property types include office, retail, industrial, hospitality (hotels, restaurants, cafes, sport facilities), healthcare (medical centers, hospitals, nursing homes, assisted living facilities), mixed use (commercial and residential), self-storage and multifamily (5+ residential units) properties. We do not provide financing on residential properties.

The Small Business Administration (SBA) is a U.S. government agency that offers a variety of loan options with the intent of benefiting small business owners. For our purposes, we utilize the SBA 504 and SBA 7a loans. SBA 504 loans are limited to commercial real estate, equipment, tenant build-outs and (in rare cases) working capital. SBA 7a loans over a broader use of funds covering just about all business financing needs: working capital, partner buy-outs, business acquisitions, commercial real estate, franchise start-ups, tenant improvements and debt consolidation. The SBA provides incentives to our banks and credit unions resulting in more aggressive lending that ultimately benefits small business owners. The net result is typically better loan terms for business owners. This comes in the form of lower down payments (higher leverage), 25-year fixed rate on the SBA 504 portion of the loan, more flexibility and longer terms than many conventional loans.

The primary focus is in the occupancy. To be eligible for an SBA loan, your business must occupy at least 51% of the square footage of the building. The business must also operate as a for-profit company in the United States, have a tangible net worth of less than $15 million and have an average net income of less than $5 million after federal income taxes for the two years preceding your application. Ineligible properties would be leased out primarily to third party tenants as in the case of apartment complexes, retail strip centers, etc.

The biggest differences between Monarch and a traditional lender are the options and experience we provide. Not only our expertise but also connections to experienced individuals that work for lenders locally, regionally and nationwide. We go beyond the personal banker in the branch and work directly with experienced business development officers, vice presidents, and underwriters at 80+ different lending institutions across the nation. As your advocate we maintain and facilitate discussion, education, options, documentation collection, and anticipate potential problems to ensure that your best interests are in mind. Speed, efficiency, options, and communication are what set Monarch apart from any specific bank. Monarch has an average of 24-hr response time to incoming applications, meaning that almost every application is attended to on the same business day. We stay with you throughout the entire process as your advocate to ensure our processing continues through each step along the way making sure the necessary steps are being taken to progress you loan to closing.

Not sure where to start or what type of loan is best? Drop me a message with a few details and I will respond as quickly as possible.